U.S. Tax Form W-9 (Request for TIN)

Free Blank W9 Form in PDF for 2024

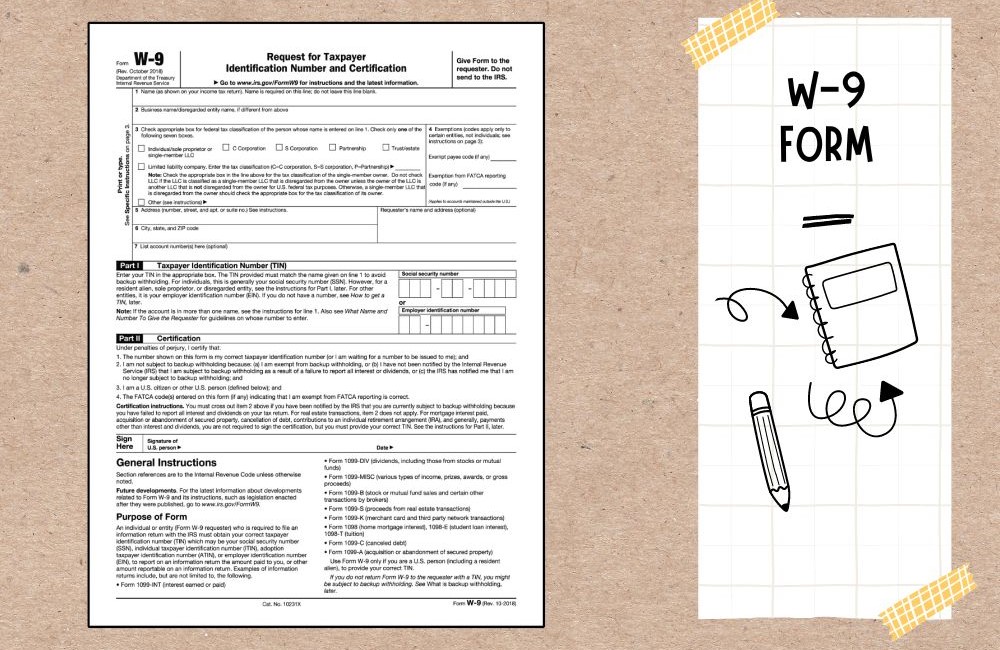

Get FormTax season often brings a flurry of forms, terms, and regulations that can bewilder even the most financially savvy individuals. Among these documents sits the W9 IRS tax form, a crucial piece of paper for any freelancer, independent contractor, or self-employed person to understand. The form’s primary function is to provide essential information to entities that will pay you income; it enunciates the taxpayer identification number (TIN) or Social Security number (SSN) that is indispensable for reporting earnings to the Internal Revenue Service (IRS).

Beyond its basic role, the tax form W9 for 2024 is used to certify that the information provided is correct and that the individual is not subject to backup withholding— a critical step for both the payee and the payer. Considered a statement of accuracy and responsibility, it's an attachment to the compliance and legitimacy of the financial transactions between parties, serving as a vital cog in the machinery of the U.S. tax system. This form, while not directly submitted to the IRS by the individual, will influence the nature and obligations of their tax returns.

Notable Changes to the IRS W9 Form for 2024

As we look forward to tax filing in the year 2024, staying alert to any revisions made to tax forms is pivotal for taxpayers. While changes to the W9 form are relatively infrequent, they are crucial when they occur. These alterations may be in response to tax law revisions, shifts in regulatory demands, or simplification efforts aimed at streamlining financial reporting requirements. Taxpayers are encouraged to review the form annually to ensure that they comply with current standards and provide the most up-to-date information to payers.

Who File the W9 Tax Form

Determining eligibility to file the W9 tax form is a straightforward process. The document is typically required from individuals who are working as freelancers, consultants, or independent contractors. Moreover, it may be requested from persons engaged in other forms of contingent work where the employer does not make tax withholdings. That said, the form is not universally applicable; for example, traditional employees who receive a W-2 should not fill out a W9, as their tax details are handled differently.

File IRS W-9 Tax Form on Time

It's also key to note that failure to submit U.S. tax form W-9 when required can lead to penalties or the imposition of backup withholding; hence, the form's pivotal role cannot be overstated. Comprehending your status and the relevance of the form to your financial situation can help you avoid unnecessary complications and ensure compliance with IRS guidelines.

Best Practices for Contractors Preparing the W9

- To keep financial affairs without a hitch and ensure the smooth handling of returns, it's wise for contractors to secure a copy of the W9 tax form well in advance of when it is needed.

- Anticipation is better than rectification; maintaining an updated form ready to hand over upon request minimizes the risk of delayed payments and tax-related snarls.

- Timeliness is indispensable when dealing with tax documentation. Contractors should provide the completed form to their clients promptly, which allows for accurate 1099-MISC reporting and other potential tax documentation that may be required down the line.

- Furthermore, careful record-keeping is encouraged; maintaining copies of the W9 form provided to each client can serve as useful documentation if discrepancies arise or in the event of an audit.

Attentiveness to the instructions for the W9 tax form is paramount. Reading every part thoroughly will ensure all fields are correctly populated and that there's clarity on terms such as 'exempt payee.' Following these guidelines fortifies one against misconceptions and safeguards against punitive measures due to non-compliance. Through vigilance and adherence to tax form protocols, one can navigate the turbulent seas of tax season with greater ease and certainty.