Printable Form W-9 for 2024

Free Blank W9 Form in PDF for 2024

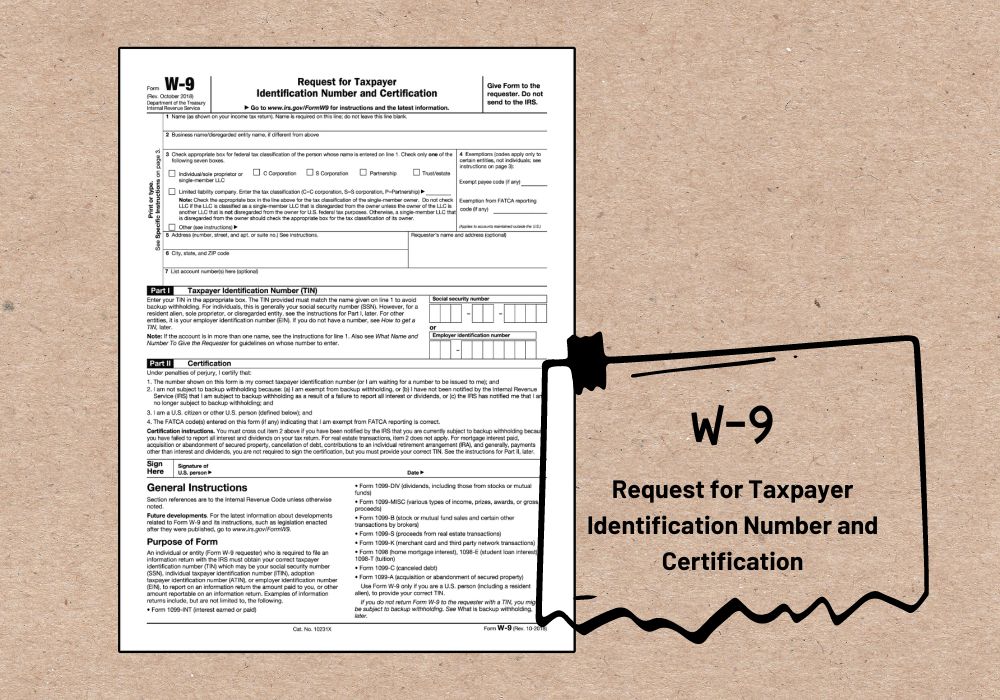

Get FormIf you are a freelancer, an independent contractor, or dealing with certain financial transactions in the US, you'll likely need to be familiar with IRS Form W-9. This form is an official request for taxpayer identification number and certification. Its primary purpose is to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file information returns with the IRS to report interest, dividends, and certain other income paid to you.

The printable blank W-9 form is straightforwardly divided into several key parts. At the top of the form, you will find fields for your name and business name (if different). Below, you must choose your federal tax classification and address. The central portion of the form is where your Taxpayer Identification Number - either your Social Security Number (SSN) or Employer Identification Number (EIN) - is entered. The final segment is the certification part, where you sign and date, attesting that the information provided is correct.

Rules for Filling Out Form W-9 Accurately

- Ensure your name matches the name on your tax return.

- If you are doing business as another entity (DBA), enter this name as well.

- Select the correct federal tax classification for your situation.

- Your address should include the full location where you can receive mail.

- Enter your TIN accurately—this could be your SSN or EIN.

- Read the certifications carefully before signing.

Guide to Filing Your IRS W-9 Form

Filing your completed Form W-9 is crucial to ensure you remain compliant with IRS regulations. Here, we provide a step-by-step guide on proceeding once your form is ready.

- Download the Form

Obtain the IRS W9 printable form for 2024 from our website. It is available in a format suitable for printing. - Print the Copy

Ensure you use a quality printer so that all information remains legible. Grainy or faded text could lead to processing delays or errors. - Complete the Copy

Use black ink and write legibly, or type your information into the form following the rules outlined above. - Review Information

Double-check all filled details for accuracy before signing and dating the form. - Physical or Electronic Delivery

Depending on the requester's preference, deliver the signed form either in person, by mail, or electronically. - Keep a Copy

It's always wise to retain a copy of the signed printable Form W-9 for 2024 for your records in case any questions arise later.

Filing Schedule for IRS Form W-9

The IRS does not set a specific deadline for submitting a W-9 printable form to the IRS, as this form does not get filed with them directly by you. Instead, the form is requested by and delivered to individuals or entities that pay you during their tax document preparation. It's typically requested at the start of a business relationship or when your information has changed. It's pivotal to complete and return it promptly to avoid backup withholding, where payers must withhold taxes from your income at a flat rate and send this directly to the IRS. This can affect your cash flow and complicate your tax reporting.

By understanding the structure of the Form W-9, adhering to these guidelines, and timely managing its filing, you can make this aspect of financial management smooth and painless. Remember that an accurately completed IRS printable W9 form for 2024 can have a significant impact on your tax dealings, so take care to ensure everything is in order.