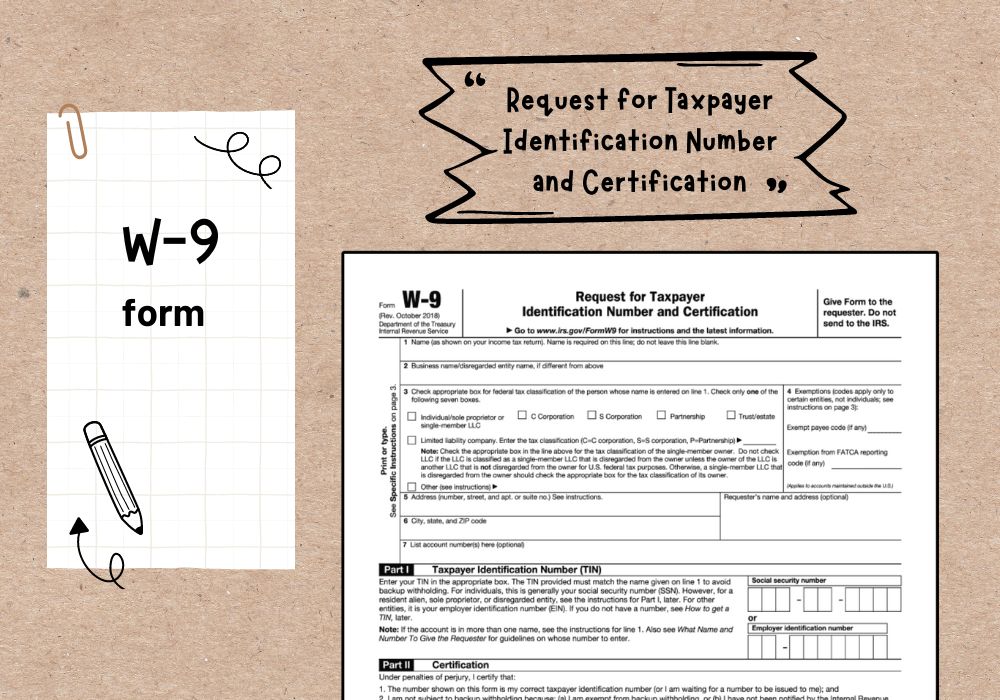

Form W-9 for 2024

Free Blank W9 Form in PDF for 2024

Get FormAs the new fiscal year approaches, taxpayers and businesses are gearing up for the well-known dance of documentation accompanying reporting income and complying with the IRS’s regulations. One of the most essential documents is the federal tax form W-9 for 2024, a staple in the financial activities of countless Americans. But just what is this form, and why is it critical to understand its use as we move towards 2024? Let's delve into the purpose of this document and unravel its importance in the tapestry of fiscal responsibility.

The W-9 Blank Form for 2024: Key Takeaways

The online W9 form for 2024 is essentially an identification tool employed by businesses and individuals to provide correct taxpayer identification numbers (TINs) to entities that pay them income. More specifically, if you work as an independent contractor or receive certain types of income, such as interest, dividends, or real estate transactions, you'll likely be asked to complete a W-9. This form lays the groundwork for other tax documents, like the 1099 form used to report various types of nonemployee compensation.

IRS W-9 Form: Vital Considerations When Completing

- Confirm your Taxpayer Identification Number (TIN) is accurate — this includes your Social Security Number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN).

- Ensure your personal or business name matches the name on your tax return to avoid any discrepancies when the IRS processes your forms.

- Be aware of the privacy of your information, and only provide your W-9 to legitimate requesters you trust.

- Understand the specific instructions for exemptions—if you qualify for an exemption, proper notation on the W-9 is crucial.

While it may seem straightforward, handling the fillable 2024 W9 form requires attention to detail to ensure accuracy. Neglecting these aspects can lead to errors that may trigger IRS notices or audits.

Printable IRS W9 Tax Form: Avoiding Common Mistakes

Frequent missteps can complicate tax reporting for individuals and businesses alike. To preclude such issues, let's consider these common pitfalls:

- Blank spaces

It's critical when you deal with the blank W-9 form for 2024 printable not to leave any required fields empty. All relevant sections must be filled out to consider the document complete. - Name mismatch

Always double-check that the name provided aligns with IRS records—personal names should match what's on your Social Security card, and business names should correlate with official documents. - Outdated information

Regularly update your W-9 if there have been any changes, such as name, address, or TIN. - Incorrect exemption claims

Claiming an exemption incorrectly can result in unnecessary withholdings and complications with the IRS. Be sure to consult with a tax professional if you're unsure about your exemption status.

By keeping an eye out for these common blunders and following the advice provided, you can ensure that your 2024 printable W-9 form is impeccable, paving the way for a smooth tax season. Remember, taking the time to fill out the W-9 correctly and thoroughly is an investment in a hassle-free tax experience.